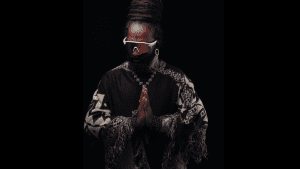

A proposed class action lawsuit has placed electronic music star Steve Aoki at the center of a growing legal battle over celebrity-backed crypto promotions, raising fresh questions about influencer accountability in the NFT boom era.

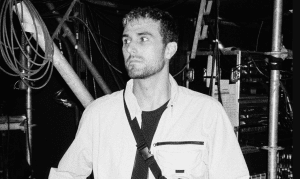

Filed in federal court, the case alleges that Aoki and DraftKings co-founder Matt Kalish violated U.S. consumer protection laws by promoting a digital collectibles project without disclosing their financial ties to the company.

Allegations of Undisclosed NFT Promotions

According to court filings first reported by Front Office Sports, the lawsuit claims the two high-profile figures aggressively marketed NFTs from crypto gaming startup MetaZoo on Instagram between 2021 and 2022.

During that period, MetaZoo generated tens of millions of dollars in sales as interest in NFTs surged. The company later filed for bankruptcy protection in 2024, leaving many token holders with assets that have since become effectively worthless.

Investor Says He Was Misled by Celebrity Endorsements

The lead plaintiff, Evan Berger, alleges he purchased 26 MetaZoo NFTs after seeing repeated social media posts from Aoki and Kalish praising the project’s potential.

Berger claims he relied on their apparent enthusiasm and public confidence, believing the endorsements were organic. He argues that had he known they were financially compensated, he would have sold his holdings earlier.

At its peak, Berger’s collection was reportedly valued at more than $150,000. Today, according to the lawsuit, those assets have no remaining market value.

Livestream, Blockchain Records, and Ethereum Transfers

The complaint highlights a livestreamed poker game hosted at Aoki’s home, where both defendants allegedly discussed the future value of MetaZoo tokens.

Blockchain data cited in the filing shows that roughly 90 Ethereum was transferred from MetaZoo to wallets linked to Aoki and Kalish shortly after the broadcast. The lawsuit presents this transaction as evidence of undisclosed compensation tied to promotional activity.

FTC Rules at the Center of the Case

Federal Trade Commission guidelines require influencers to clearly disclose paid partnerships. Meta, Instagram’s parent company, enforces similar rules around sponsored content.

The lawsuit alleges that Aoki and Kalish ignored these standards, presenting themselves as neutral collectors while actively encouraging followers to buy MetaZoo NFTs—actions the plaintiffs say artificially inflated demand.

A Lawsuit With Broad Implications

The proposed class action aims to represent tens of thousands of U.S. buyers who purchased MetaZoo NFTs during the promotional period.

Berger is seeking at least $5 million in baseline compensatory damages, a figure that could rise if the court certifies the class and additional claims are upheld.

As regulators continue scrutinizing celebrity crypto endorsements, the Steve Aoki NFT lawsuit could become a defining case for how far influencer responsibility extends in digital asset marketing.

Comments are closed.